The reorganization at Helvetica enables stringent management of the real estate investments and bundles the forces in the company management. We spoke to Dominik Fischer, designated Chief Investment Officer (CIO) of Helvetica, about the additional perspectives he brings at management level, how he implements the investment strategy of the funds and how he intends to ensure sustainably stable returns for investors.

Interview: Patricia Neupert, Head Marketing and Communications

What complementary perspectives do you bring to Helvetica's investors in your new role as Chief Investment Officer (CIO)?

During my professional career, I have had an insight into various areas of the property industry and have been able to gain a wide range of hands-on experience. With this multi-layered perspective, from property management to asset and portfolio management to the transactional property business, we will create added value for our investors. In addition, as a representative of the younger generation, I would like to ensure that Helvetica's development is sustainable and digitally strong for the future.

What is your leadership style, and how do you plan to influence and advance Helvetica and its investment portfolios?

I adopt a non-micromanagement approach, focusing on nurturing talent and cultivating team members into proficient leaders. Our corporate culture is defined by our identity as entrepreneurs, not mere managers. We make substantial investments in our employees, offering perspectives beyond the operational core, and emphasizing continuous learning. I believe that the internal knowledge reservoir is frequently underestimated but plays a central role in ensuring efficiency, success, and customer-centric practices.

You've been with Helvetica for five years now. How has the company changed during this time?

Helvetica has grown from a small fund manager into a major market player for property investments. We now manage almost CHF 2 billion in assets under management for public, qualified and institutional investors. We have transformed ourselves into a professionally structured company with efficient processes without losing our unique culture or agility. We now have almost 40 employees who build and develop customized real estate services to generate sustainable returns.

Helvetica is currently implementing comprehensive portfolio optimization in the individual funds. What strategic goals are you pursuing with this?

We are currently optimizing all of our funds based on the current market situation. The aim is to streamline the portfolios to maximize returns and minimize risk, both geographically and structurally. In this context, we have already sold a few properties in order to reduce debt financing. We are also working on a new financing strategy that, among other things, ties some of the mortgages to longer terms in order to increase cash flow stability.

What reactions have you had to the sales you have already made on the transaction market?

Very positive. In the second half of 2023, we have so far completed two sales totaling around CHF 24 million for the Helvetica Swiss Commercial Fund. The property in Chiasso in Ticino reflected the property valuation of the external valuation expert and the property in Münchwilen in Thurgau was sold above market value at CHF 13.4 million. The successful market absorption confirmed the intrinsic value of the properties held by the fund.

Helvetica has also expanded its value chain to include its own property management. To what extent will this improve the overall investment approach and benefit investors?

Thanks to our in-house property management, we are even closer to our properties and tenants, can recognize potential risks immediately, exploit opportunities at first hand and realize potential. This proximity enables us to optimize costs, plan investments in advance and guarantee high quality standards. Long-term tenancy agreements with solvent and satisfied tenants play a key role here, as they lead to the most consistent and sustainable income. The resulting synergy effects should be passed on to our investors and generate optimum returns.

What other strategies does Helvetica use to exploit the potential of its properties, particularly in terms of utilization reserves and sustainability?

Our primary goal is to balance supply and demand at the optimum rent level. We pursue various approaches to achieve this: From more efficient utilization of space in existing properties to repositioning and investments, particularly in energy-efficient renovations and sustainable building improvements. Our hands-on mentality and active management approach with customized investment plans for each property and its users are central to our letting strategy.

How are sustainability aspects anchored in the investment strategy of Helvetica's funds?

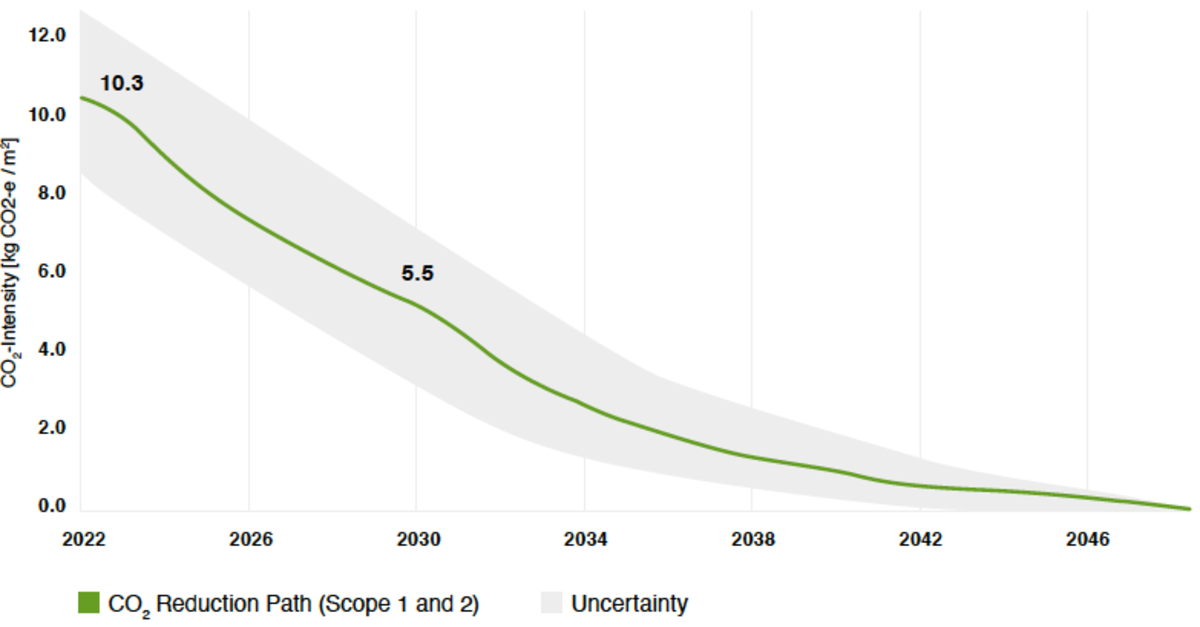

Sustainability is a top priority for us. Appropriate measures are consistently planned when purchasing properties and implemented and monitored throughout their entire life cycle. We are in the process of integrating benchmark systems such as the REIDA index and assigning each property a GEAK label. We have also defined a CO2 reduction path with specific milestones for the funds and are aiming for the challenging target of "net zero" by 2050.

In your opinion, what are the challenges facing the Swiss property market today?

The challenges are many and varied. For me, the most important ones include the increasing shortage of affordable housing, increasing regulatory intervention in the property market and the interest rate policy, which has had a major impact on the current year. The current market shows us how quickly market sentiment can change.

What message would you like to pass on to Helvetica's investors?

Firstly, I would like to thank them for their trust. In view of the changing market environment, we have recognized the need to adjust our strategy. Coming from a phase of strong growth, we are currently focusing on portfolio management and risk management and optimizing our funds on an ongoing basis. We are using the changes in the markets to innovate, improve and emerge stronger than before. Helvetica's new, multi-member management team is highly experienced and fully committed to ensuring long-term, stable growth with sustainable and stable returns in the interests of investors.

![[Translate to Englisch:] [Translate to Englisch:]](/assets/_processed_/f/5/csm_Dominik-Fischer_f14ef74de8.jpg)