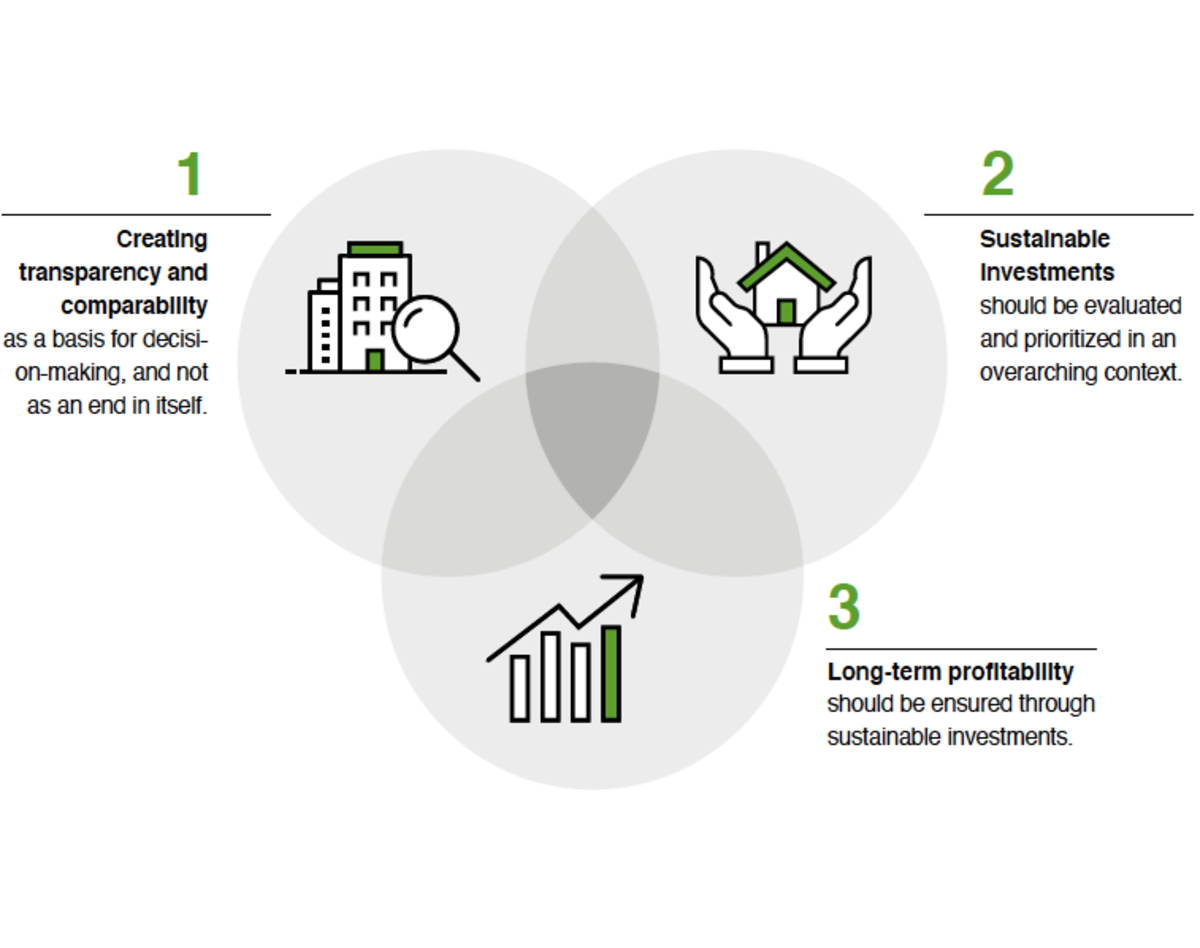

What sustainability means to us

The commitment to sustainable action forms the basis of Helvetica's mission «Building Enduring Value».Our focus is on protecting and growing our clients' wealth with long-term and responsible investments in real estate for generations to come.In everything we do, we strive to protect our planet and promote a sustainable, fair and transparent society for all.

How we will measure success

At Helvetica, we are committed to leading the charge towards sustainable business practices. We firmly believe that transparent reporting of our sustainability initiatives and progress can not only differentiate us from our competitors, but also inspire others to follow suit. By providing honest and comprehensive information about our company-wide sustainability practices, we aim to empower stakeholders to make informed decisions and contribute towards a more sustainable future.

Principles for Responsible Investment

Helvetica is proud to be a signatory of the Principles for Responsible Investment (PRI). As a signatory, we commit to incorporating ESG issues into investment decisions where consistent with fiduciary responsibilities. The PRI network comprises more than 4,300 signatories representing over USD 121 trillion in assets under management.

Swiss Sustainable Building Council

As an SGNI member, Helvetica makes its commitment to sustainability visible. We benefit from a strong network, continue our education with the prestigious course programme and actively contribute to the promotion of a sustainable real estate industry in Switzerland.

Sustainable Development Goals

Helvetica supports all 17 SDGs of the UN's Agenda 2030 for sustainable development, but focuses on three goals that can have a measurable impact on environmental and social conditions: decent work and economic growth, sustainable cities and communities, and climate action.

Swiss Sustainable Real Estate Index

Helvetica participates in the SSREI to create more transparency at asset level and to lay the foundation for international benchmarks. The SSREI was launched with the aim of mapping the sustainability profile of existing Swiss properties and enabling comparability. The assessment results provide valuable insights and concrete pointers for improvements. From this, targeted measures can be derived to safeguard the value of the properties.

A systematic, strategic framework

This past year we undertook a materiality analysis to determine which aspects of sustainability were most relevant for our business and the outside world. Our analysis looked at economic issues – the factors that influence our ability to succeed as a firm long term – as well as environmental, social and governance issues.

Read more about our materiality analysis and goals for improvement in our new sustainability report.