From navigating the aftermath of the Credit Suisse collapse to harnessing the power of artificial intelligence, Helvetica's charismatic founder shares his bold vision for the future of the Swiss financial industry 2.0. In this exclusive interview, he offers a rare glimpse into his personal beliefs, unwavering determination, and ambitious plans for Helvetica as they embark on their journey to redefine the financial landscape. Get ready for an inspiring and thought-provoking conversation you won't want to miss.

Mr. Holdener, our readers are eager to learn about your long-term plans for Helvetica. Could you share some insights with us?

Over the past 12 months, we've been diligently working on our Duforspitze 2025 strategic plan. In a nutshell, our goals include doubling our AUM to 4 billion Swiss Francs, expanding into the private clients market, and potentially exploring opportunities in the mandates and advisory business.

Given the ambitious nature of your plans, how do you stay motivated on achieving them?

Our ambitious goals reflect my personal belief, inspired by Michelangelo, that it's better to aim high and fall short than to aim low and succeed. I have faith in our team's ability to adapt and overcome challenges as markets normalize. By setting lofty goals, we stay motivated and push ourselves to reach new heights.

As the founder of Helvetica, could you share your personal thoughts on the current state of the global economy, specifically focusing on the Swiss financial industry?

The Swiss financial industry has come under particular scrutiny due to recent events, but that's alright – the quality of Switzerland remains stronger than ever. These shake-ups can be beneficial from time to time, as they help us refocus on our business. However, we must strive for an improved version of the Swiss Financial markets 2.0. My greatest concern is the "whatever it takes," black and white approach to the green agenda. It's never a good sign when questioning becomes off-limits.

How has the recent Credit Suisse collapse influenced Helvetica, and have you identified specific opportunities or challenges arising from this situation?

The Credit Suisse collapse has been a wake-up call for the entire industry. It prompted us to reevaluate our risk management and focus on building a robust and sustainable business model. We've identified some opportunities to gain market share and serve clients disillusioned by the situation. We'll have to wait and see, but at least we hope to become more relevant to our investors. Our nearly 20 years of experience should count for something, I hope.

Have you noticed any changes in the behavior of institutional investors?

Absolutely, they're reevaluating their risk matrix, which is a wise move. The big players aren't always as safe as one might think. The considerable risks associated with the merged unit of UBS and CS are also prompting many investors to diversify to smaller players like us. In my opinion, this should be a top priority for gatekeepers and investment consultants advising institutional investors. At Helvetica, we're independent of banks and accountable for our decisions, both good and bad. We simply can't afford to make big mistakes.

Considering Helvetica's growth ambitions, can you provide some insights on your approach to navigating challenges and uncertainties in the financial markets?

Our approach is to stay calm, yet agile and responsive, always putting our clients' needs first. We invest in technology and talent to ensure we can adapt to any market conditions and seize opportunities as they arise.

How is your Dufourspitze 2025 growth plan responding to the changing needs of clients, especially considering the Credit Suisse collapse?

We plan to capitalize on the opportunities arising from the collapse and position our firm accordingly. Our focus is on building a client-centric organization, providing customized solutions, and emphasizing transparency and trust even more. We believe that comprehending and addressing our clients' needs is crucial for success in this constantly evolving landscape.

What are your personal views on the role of artificial intelligence or AI in the financial industry and beyond?

Oh, im like a kid again. It feels like we're back in 1997 when the internet began. Maybe even 1892 when the first tractor was invented. AI will change everything. There are enormous opportunities ahead of us. In the mid-term, many will lose, but in the long run, we all win. At Helvetica, AI and its potential impact is a top priority.

In light of recent events, how does Helvetica plan to contribute to rebuilding trust in the Swiss financial market while enhancing its own brand reputation?

We're dedicated to maintaining the utmost ethical standards and transparency. By centering our efforts on our clients' best interests and providing secure, stable performance along with outstanding service, we aim to contribute to rebuilding trust in the Swiss financial market and further strengthening Helvetica's reputation.

As an industry leader, what are your thoughts on the future prospects for the younger generation entering the financial sector?

In my opinion, it's the best time ever to be young. The opportunities for growth, learning, and innovation are immense, and the world is more interconnected than ever before. The younger generation has the chance to shape the future in unprecedented ways.

Could you discuss the importance of ESG investing in Helvetica's long-term plan and your personal vision for the company?

At Helvetica, we adopt a pragmatic approach to ESG investing, ensuring we don't rush into things. Nonetheless, sustainable investing is crucial for long-term success. I have always been a firm believer in generating a positive impact on society and the environment. That's why we are dedicated to incorporating ESG principles into our investment strategies and decision-making processes.

How do you envision Helvetica's growth strategy adapting to the rapidly changing global landscape?

Our growth strategy focuses on what's best for the ultra-long-term, curiosity, innovation, and client-centricity. By staying true to these principles, investing in technology, and nurturing top talent, we aim to keep Helvetica at the forefront of the industry.

What are your personal views on the role of partnerships or mergers and acquisitions in driving Helvetica's future growth and expansion?

I believe partnerships are crucial for driving sustainable growth. They allow us to leverage the strengths of our partners and expand our reach, while mergers and acquisitions can be strategic moves.

Can you share the story behind the bike and explain its significance to Helvetica?

The bike has a personal connection to my life, dating back to when I was 18 years old in 1984. Over time, it has become an integral part of Helvetica's history and identity. The bike symbolizes our commitment to long-term thinking, perseverance, and caring for what matters most. It also represents our eight guiding principles, which are reflected in our mission statement of "Building Enduring Value," inspired by the bike's two wheels. Remarkably, the bike is still in great shape to this day.

Can you share your long-term dream for Helvetica and what you envision for its future?

I dream of Helvetica becoming a leading global active investment firm, renowned for its commitment to Innovation, excellence and professionalism and of course an exceptional service. My ultimate goal is for Helvetica to symbolize the Swiss financial sector 2.0, where innovation, excellence and risk-adjusted performance are at the heart of everything we do. Achieving this would be truly remarkable.

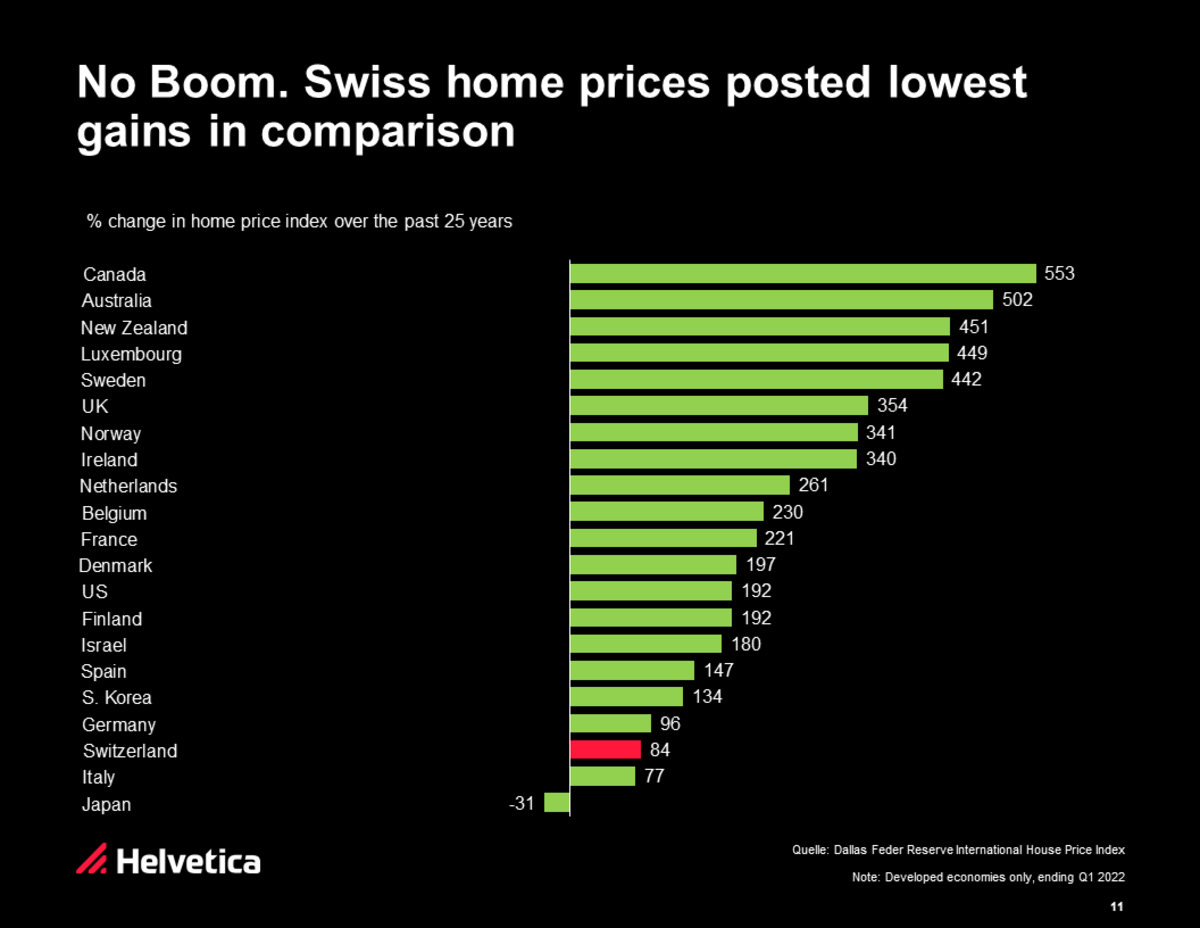

You often emphasize that the Swiss real estate market is undervalued. Can you share some factors contributing to this undervaluation?

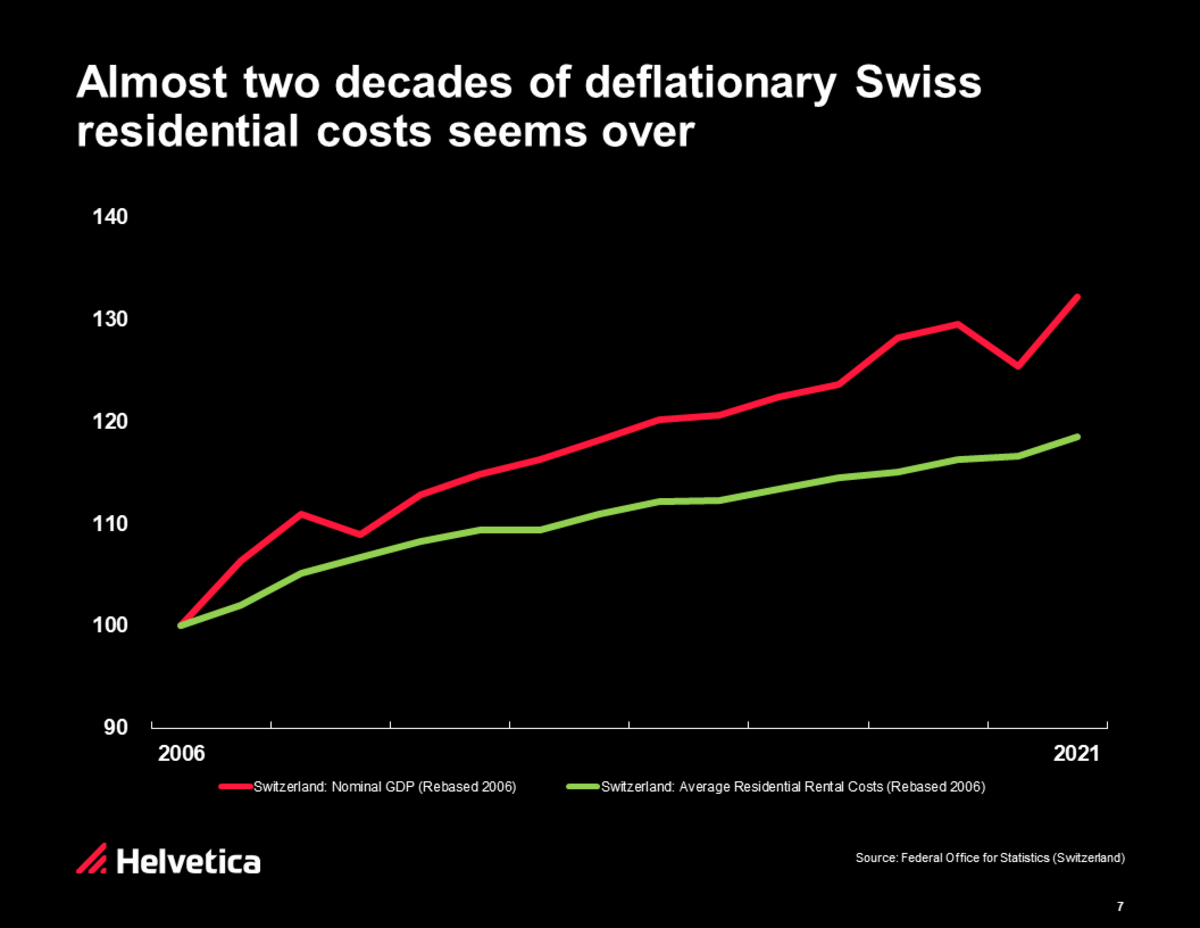

Absolutely, I've been highlighting this for years. The supply of rental space has been decreasing for almost two decades due to political reasons, strict regulations, and tightening building standards protecting tenants. Meanwhile, the Swiss National Bank's policies have resulted in a deflationary rental development for much of the last two decades. This has led to a significant undersupply with no quick fix in sight. At the same time, demand is surging due to population growth and companies moving their supply chains back to Switzerland, pushing rental prices higher than ever. There's never been a better time to enter the market.

Given the undervaluation you've mentioned, what potential do you see in the Swiss real estate market, particularly for foreign investors?

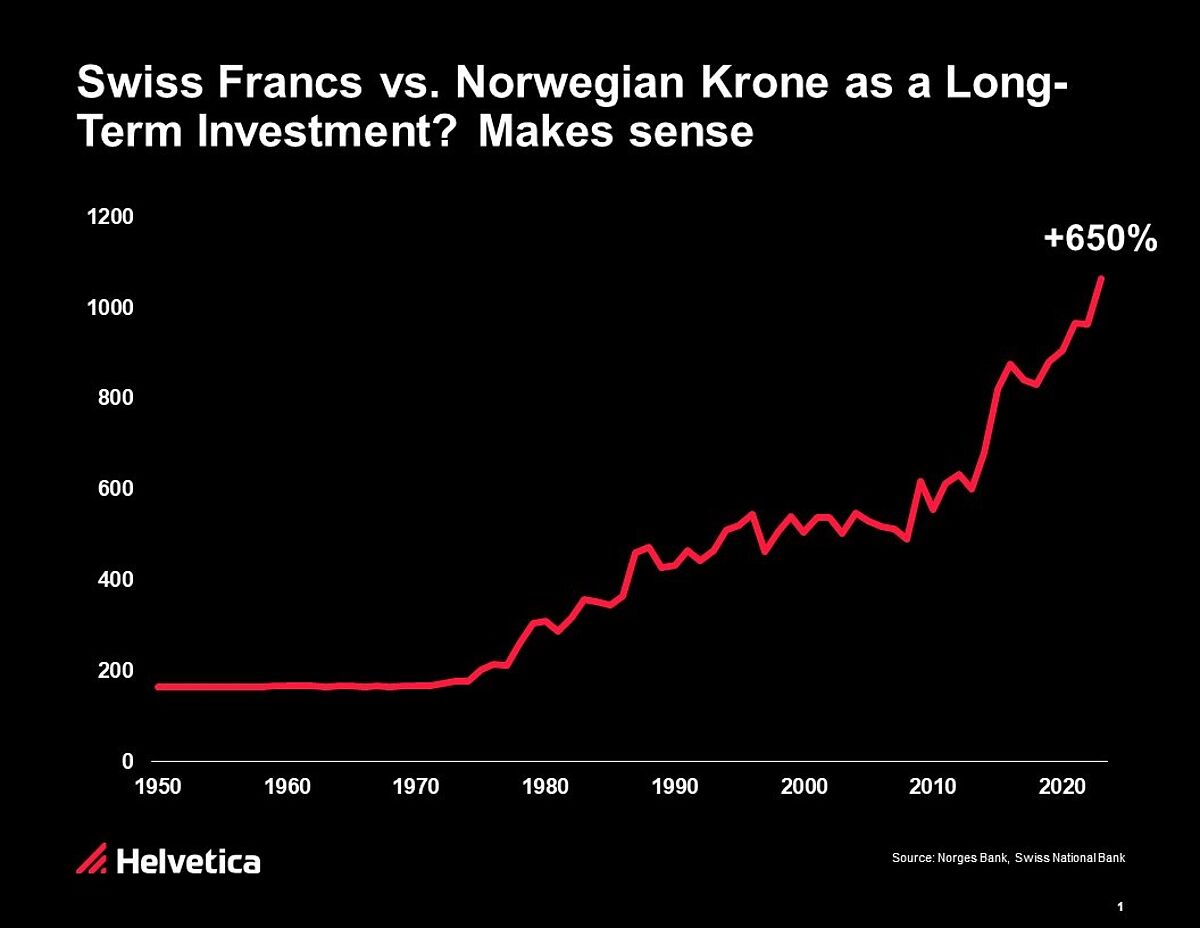

First and foremost, investing in the Swiss real estate market requires patience, a great deal of it. The market holds tremendous potential for long-term, safe, and stable performance. Switzerland's stability, strong infrastructure, and attractive investment climate offer growth opportunities that are often overlooked. This is especially true for foreign investors, who can benefit from the Swiss franc's appreciation as a bonus hedge – it's becoming the new gold standard in my opinion. However, entering the market can be challenging due to various barriers. That's why newcomers considering the Swiss real estate market should always reaching out to me for guidance – laughs.

What are your top two reasons why foreigners should invest in Switzerland?

Firstly, investments in Switzerland are safe and secure due to the country's stability and strong financial system. Secondly, the Swiss Franc consistently appreciates against other currencies, providing a great tailwind for your investments – and it's free! Just keep in mind the importance of patience when investing in Swiss assets.

As we conclude this insightful interview, Mr. Holdener would like to take a moment to share something personal with our readers?

"Thanks for asking. I would love to share my unwavering vision and dream of seeing our beautiful Helvetica brand proudly displayed atop the MET building in New York. That's my Mount Everest summit expedition," he says with a laugh.