Hans R. Holdener, do the Norwegians who are currently coming to Switzerland know your story?

No, probably not, it was too long ago.

What connection do you have with Norway?

I was born and raised in Oslo. My father is Swiss, my mother Norwegian. She comes from Åndalsnes, where I launched a gondola project a few years ago. Awesome.

Then it's true: the Helvetica story was born in Oslo?

Yes. October 2006 to be exact.

And how did it all start?

By reading about the insane demand for foreign real estate investments among Norwegians. It was a gold rush atmosphere. So I decided to set up the first fund for Norwegian investors with a focus on Swiss real estate.

So you were first movers?

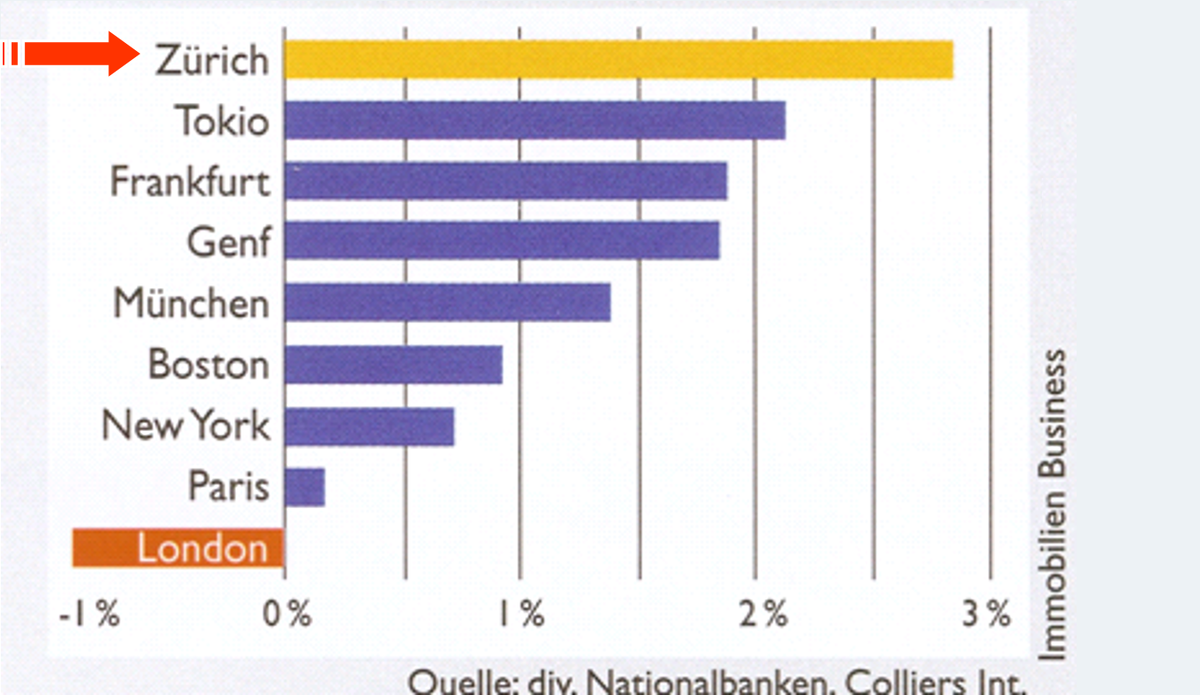

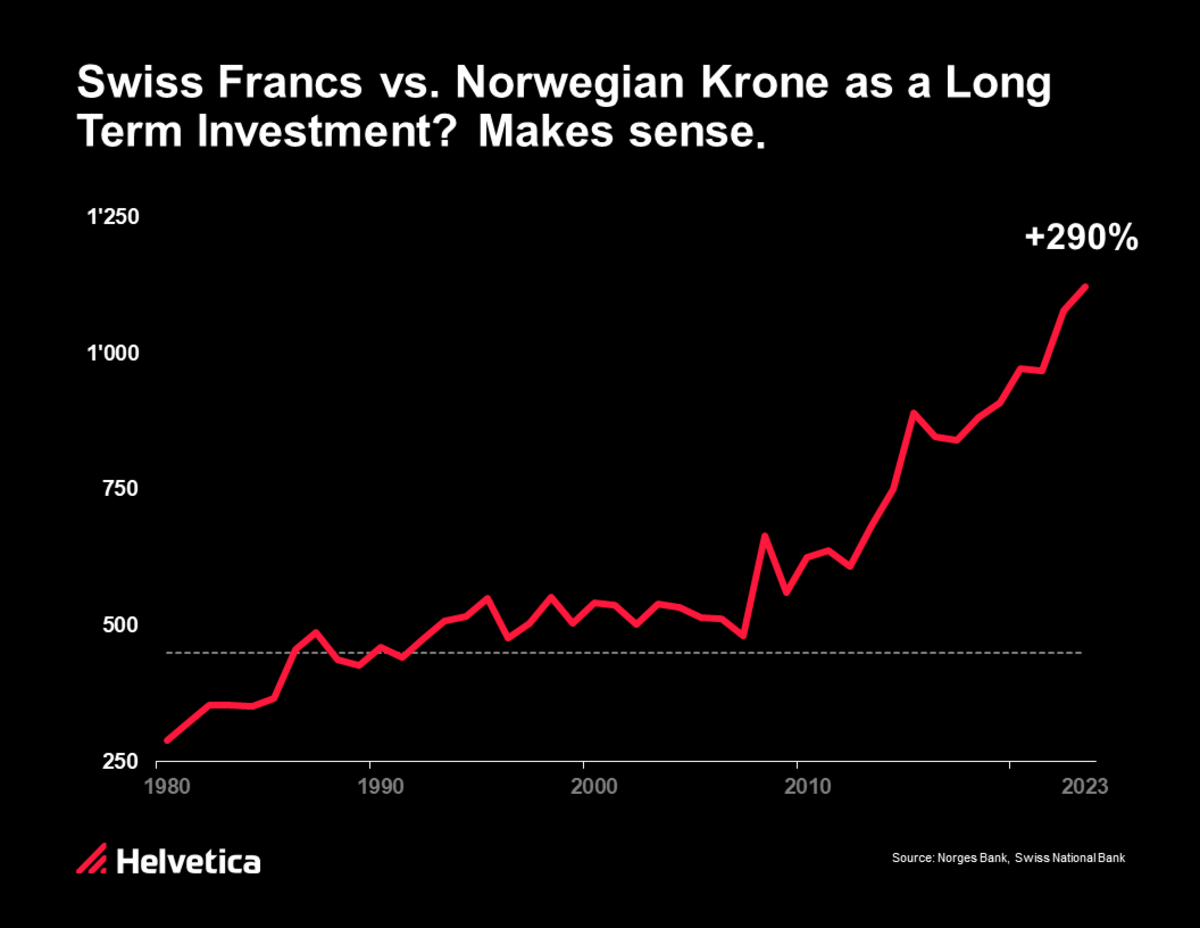

Yes. We were the first to launch a fund with focus on the Swiss market. I noticed that the difference between office prime yields and the yield on Swiss government bonds was the highest in Europe. And the Swiss franc seemed undervalued against the Norwegian Krona. I saw potential here, prices would have to rise.

So, very straightforward?

No. During our more than 30 presentations to professional investors in Oslo, we realized how poor our knowledge of the market and our network was. Actually, we had no clue. The professionals laughed at us, and rightly so. (Laughs).

Did you never lose hope?

Almost. Thanks to Pål Brudvik and Trond Vegar Brattlie from Castelar Corporate Finance, things suddenly moved quickly. They were the only ones who believed in us. I was completely surprised.

And what happened next?

After the foundation of the company in 2006, the moment had arrived early 2007. The first real estate fund for Norwegian investors was launched. It was marketed as a very conservative fund and had a loan-to-value ratio of up to 90 percent. In hindsight, quite ridiculous. (Laughs)

Were you successful?

The start was very difficult. After a lot of toing and froing, raising capital became a success. We were able to raise 145 million francs from 2,500 Norwegian investors.

A lot of money, then what?

Money in the fund, but hardly any real estate. Finding and buying real estate in Switzerland is a highly demanding task. Switzerland didn't wait for us. We've begun to get nervous.

In what way?

Reporting,18-hour days, sleeping in the office, and fancy client dinners with wine every day were the norm. If I had any idea how tough the job would be, I never would have started. The 30 kilos I gained have been lost again, thank goodness. (Laughs)

What was the famous rumor about?

Suddenly there was a rumor that the Norwegian Oil Fund was behind our company.

Was it true?

No, but the number of properties offered for sale skyrocketed almost overnight. Everyone knew about us. Mainly because of an interview with Konrad Koch in the Financial newspaper Finanz und Wirtschaft. I was suddenly one of the best-known investors in Switzerland. Even one of the 100 most important figures in the industry.

Then things moved rapidly?

Yes. By the end of 2007, we had acquired real estate worth a total of 100 million Swiss Francs. This within a few months after launch. The last deal, the 4 Towers in Zug, was signed after very hard negotiations on Friday 21 December in 2007 at 16:30. I will never forget Christmas 2007, I almost missed the flight to Oslo.

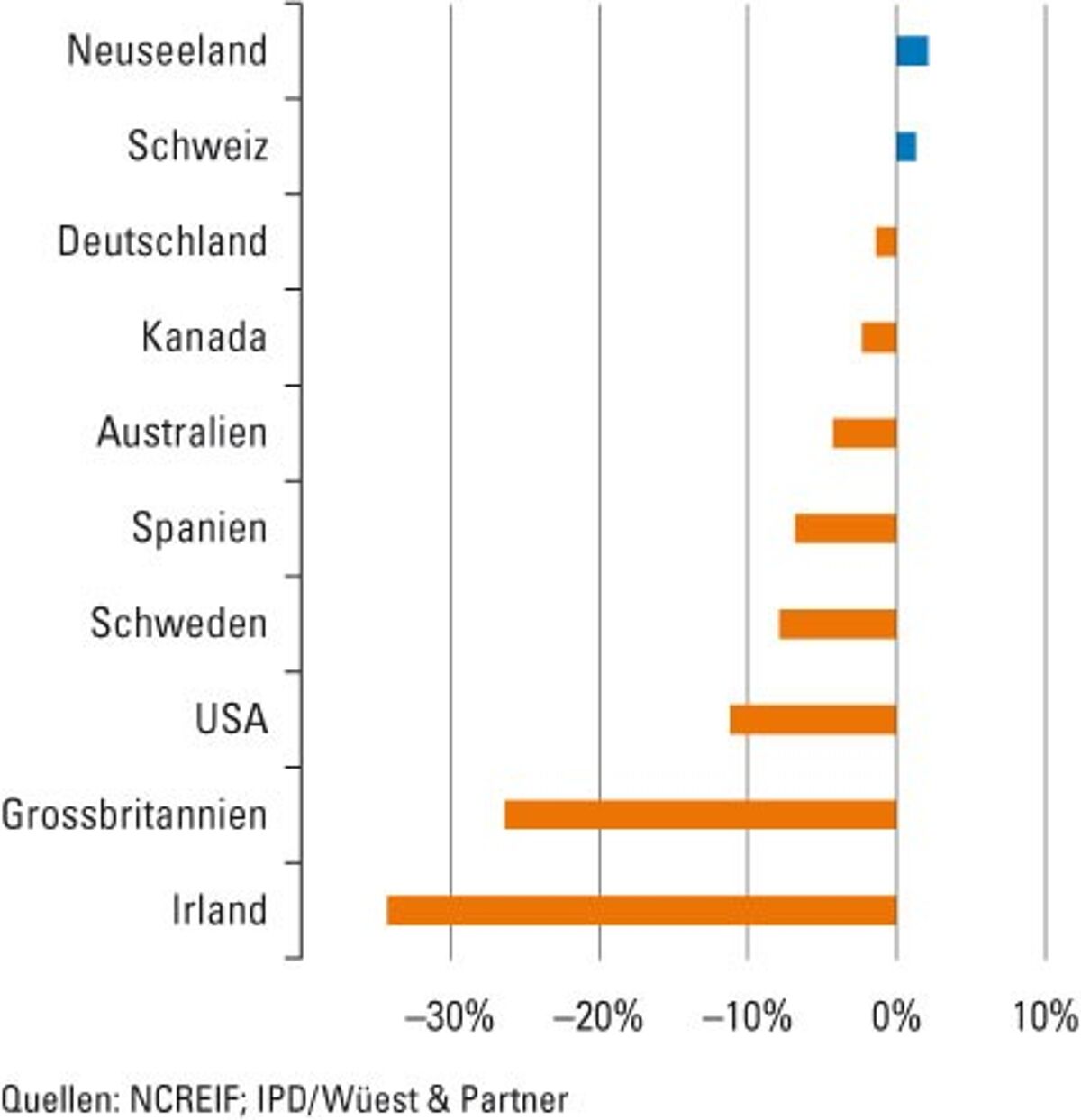

And success despite crises?

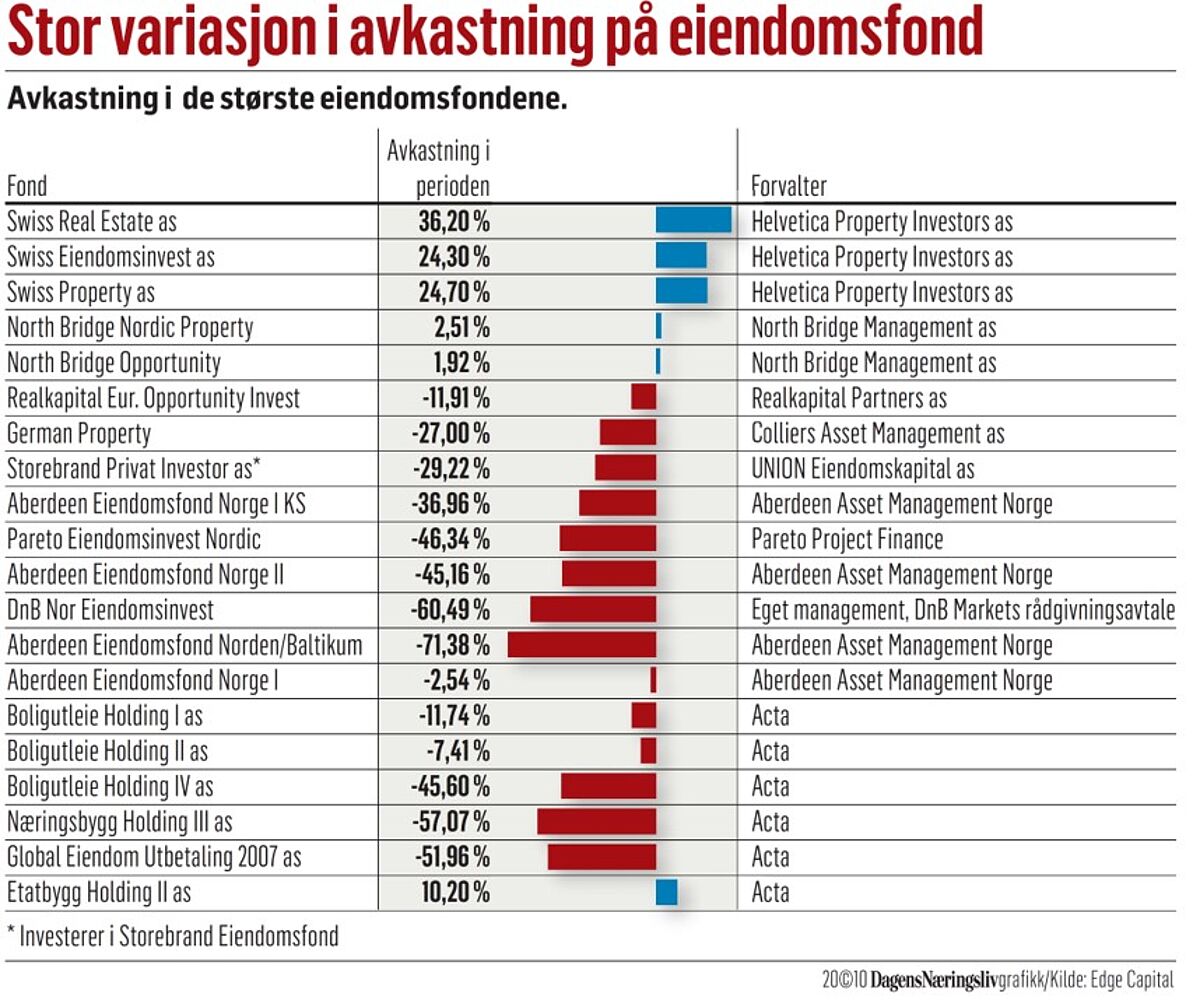

Yes. In 2010, our Swiss Real Estate Fund was the best fund. I was amazed but also proud. Just as we had hoped.

Is the fund still active?

No. Thanks to the Norwegian Thomas Gerner-Mathisen at Credit Suisse, the fund was sold in 2014 as planned with a net total return of 30 percent, despite the financial crisis and very high fund and distribution costs. We were thus able to launch our second product with Partners Group.

And now Norway is once again giving you wings?

Maybe. 16 years ago, I tried to get Norwegians to come to Switzerland, and now many come here by choice. It's really funny.

Do you recommend Norwegians to invest here?

Sure. But Switzerland is complex. 26 cantons and more than 2800 municipalities, all different markets. There are many obstacles for foreigners, but also enormous opportunities. I wouldn't do anything without an expert. The risk is too great.

Are you the right expert?

I think so. With my 25 years of successful hands-on investment experience, but also my cultural and language understanding, Helvetica is the ideal partner. Our track record speaks for itself.

Tips in a nutshell?

First, for young people planning to get rich: come to Switzerland immediately. Land of opportunity. Second, the Swiss Franc always gains value in the long run: so you have to make your money here. Third, it pays to invest in real estate in the safest country on the planet. But never alone. You need us as partners. That's how I hope to give the Norwegians wings.

Afraid of stocks?

Then you should consider investing your assets in our HSC Fund with ISIN CH0335507932. Ask your bank or contact us directly. We offer first-class service, guaranteed. Have I aroused your interest? Request free documentation or a personal consultation. Mr. Salman Baday is at your disposal at any time on 043 544 7080 or e-mail sb@Helvetica.com. Invest – now more than ever!